Payments Processing Moves From Cost Center to Revenue Driver in Global eCommerce

Commerce used to be purely physical. Then, we moved online and went mobile — and global.

eCommerce is now made up of a range of interconnected ecosystems, where consumers engage in a wealth of activities that span online and offline interactions, and even cross borders.

For instance, a consumer in Asia can play a game on a platform based in the United States and use a digital wallet to pay for it, and a family in Brazil can buy electronics to be shipped, choosing PIX to pay. Even social networks have embedded payments, and the connected economy grows day by day.

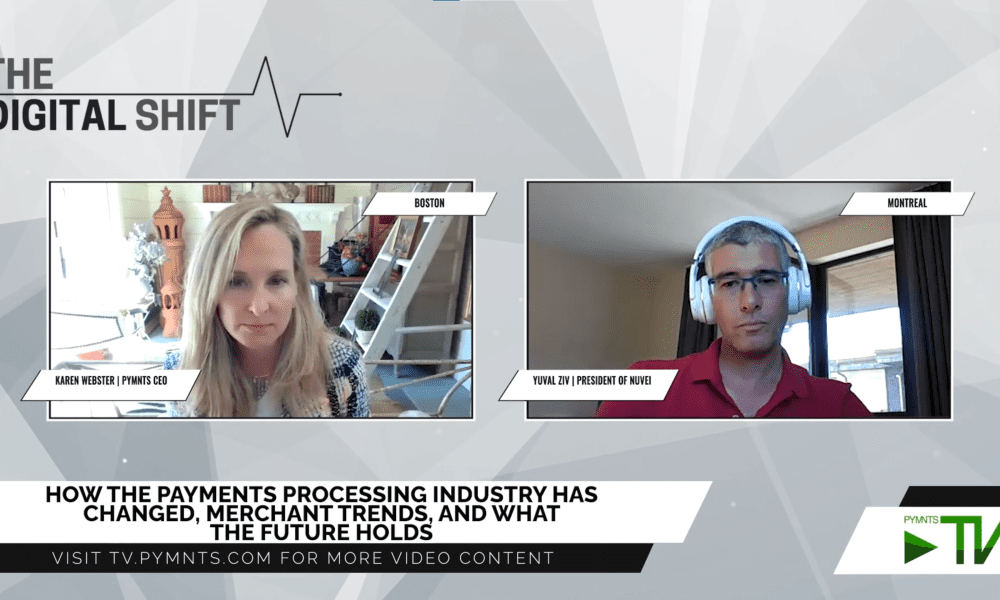

Yuval Ziv , president at Nuvei , told PYMNTS’ Karen Webster that these ecosystems add a level of complexity to commerce even as they bring the world to consumers’ doorsteps. Merchants issue cards associated with brands, checkouts vary depending on the region and sellers can gain or lose sales depending on how well they gauge the interests and preferences of their chosen markets.

The mobility industry offers a case study here, he said, where travelers used to have to get cash at an exchange kiosk, carry the new denominations with them and pay with coins and bills. However, the rise of apps and payment platforms made cross-currency transactions into a user-friendly experience, completed with a single click.

See also: Payments Platform Nuvei Launches Local Payment Acceptance for Cross Border eCommerce in 10 LATAM Countries

The payments processing industry has changed throughout the past seven years, to the point where even the notion of what payments processing is has changed. That’s happened as FinTechs and other startups have entered the space and disrupted those back-office functions.

“In the past, payments were considered to mainly be a cost center,” Ziv said. That’s no longer the case.Now, he said, payments can be revenue drivers. Payments […]

Click here to view original web page at www.pymnts.com

I am a robot. This article is curated from another source (e.g. videos, images, articles, etc.). For the complete article please use the link provided to visit the original source or author. Content from other websites behaves in the exact same way as if the visitor has visited the other website.

Warning: The views and opinions expressed are those of the authors and do not necessarily reflect the official policy or position of MichelPaquin.com.